Risk Management

FMDQ Clear provides robust and prudent risk management services for the operationalisation of its Central Counterparty (CCP) mandate in the Nigerian financial market and beyond. The CCP utilises an efficient Risk Management Framework to safeguard the interest of its shareholders and ensure the stability of the financial market.

FMDQ Clear maintains multiple layers of risk controls which seek to reduce the likelihood that a Clearing Member will default and to manage the risk to the CCP in an event of default for all product category it clears.

Click on image to preview

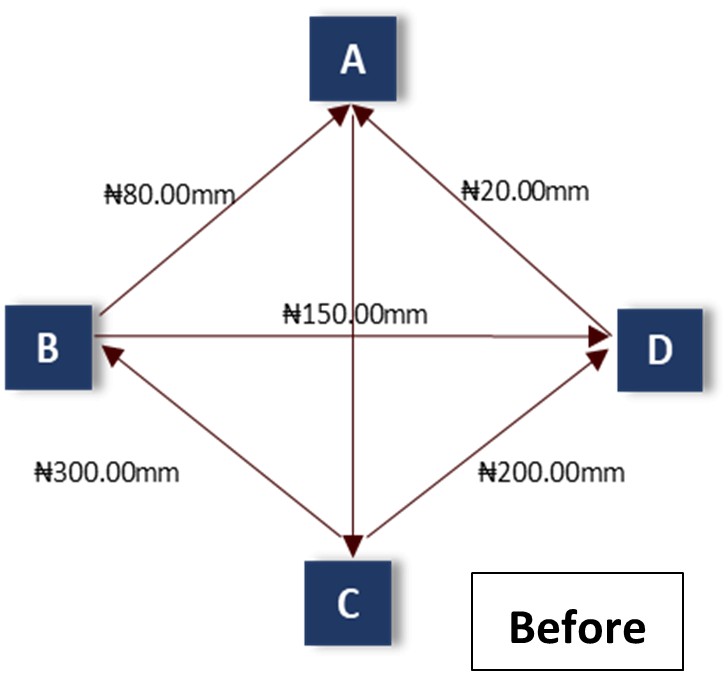

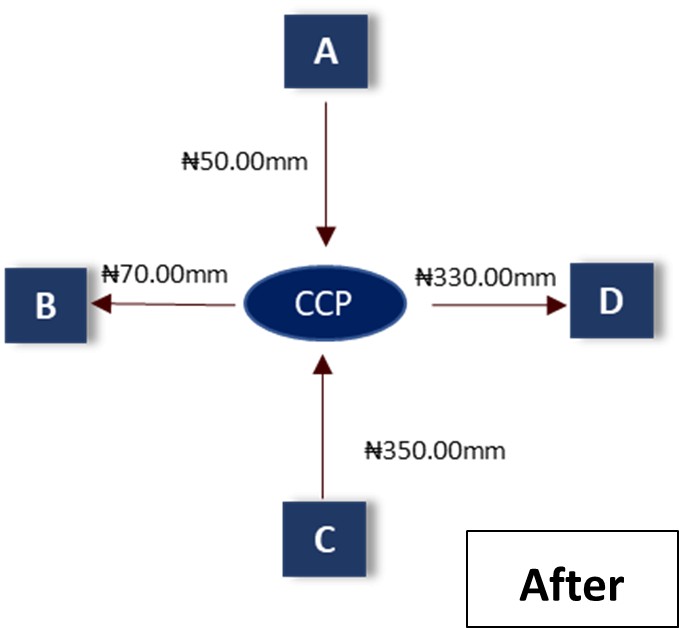

Margining plays an important role in eliminating counterparty risk by ensuring that the CCP can meet its obligations in an event of default. In line with international best practice, FMDQ Clear applies the ‘user pays’ margining approach and calculates margins only on transactions received and novated by FMDQ Clear. There are two (2) types of margins calculated by FMDQ Clear:

- Initial Margin: covers any forward-looking losses and is calculated using a historical value at risk (HsVaR) methodology to determine the maximum potential loss for a cleared product segment

- Mark-to-market: a daily revaluation of cleared transactions to reflect their current value as at close of business

Margins are requested by FMDQ Clear to ensure that a Clearing Member is able to cover its settlement obligations resulting from its trading activity on cleared products. The margins to be posted by Members and the risk calculations are determined for each product segment:

- Derivatives

- Cash

- Repos

FMDQ Clear operates the “cross default” and the “no contamination” principles of margin respectively for Members and between segments.

This means that if a Member defaults, in accordance with the “cross default” principle, it does so in all segments and the cost of the overall close-out must be covered by the member’s individual guarantees, regardless of the segment the default corresponds to. Nevertheless, FMDQ Clear’s specific margins and those posted collectively by the Members for each segment follow the principle of “no contamination”, meaning that if a Clearing Member is only active in a product segment, it will not be exposed to potential losses as a result of the default of another Clearing Member in the other product segments it does not participate in. meaning that if a clearing member is only active in a product segment, it will not be exposed to potential losses as a result of the default of another clearing member in the other product segments it does not participate in.

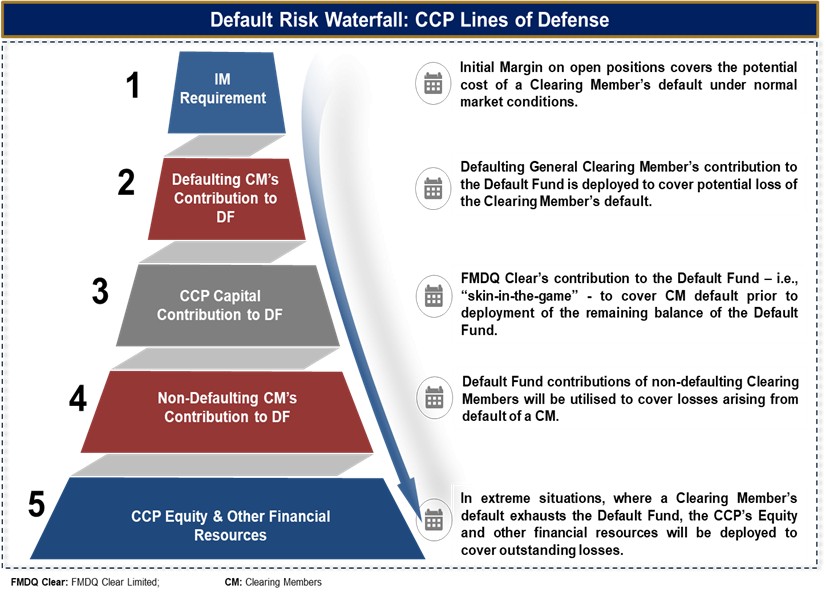

Whilst FMDQ Clear maintains a robust risk management framework designed to prevent Clearing Members from defaulting on their obligations, FMDQ Clear has put in place contingencies to manage such an unlikely event. FMDQ Clear maintains default resources in the form of initial margins and the Default Fund contributions by the Clearing Members and the CCP. The Default Fund is maintained per product segment and contributions by Clearing Members is prorated based on the applicable membership category.

The Default Fund is a mutualised guarantee fund that will be used only to cover the losses arising from the default of a Clearing Member in instances where the initial margins of the defaulting Clearing Member are not sufficient to cover the payment obligations. In line with the International Organisation of Securities Commissions (IOSCO) Principles for Financial Market Infrastructures, FMDQ Clear conducts a stress test to determine the adequacy of the Default Fund size and issues notification for additional individual contributions from Clearing Members, where necessary.

FMDQ Clear operates a ‘Defaulter Pays’ approach for the management of a default event. During a default situation, any shortfall or losses will at the outset be covered by initial margins, excess cash and collateral of the defaulting member. Should these be insufficient, the defaulting Clearing Member’s contribution to the Default Fund will be deployed to meet payment obligations resulting from the default. FMDQ Clear shall subsequently utilise its default resources in line with its default waterfall to mitigate a default event.