Clearing Process

FMDQ Clear provides clearing services for the financial market products traded on FMDQ Exchange including Spot, Repo and Derivatives products. View products cleared. FMDQ Clear acts as the Central Counterparty (CCP) and guarantees settlement of transactions effected by the transaction counterparties including the FMDQ Clear registered Clearing Members.

Details of all traded products are electronically and automatically transmitted to FMDQ Clear once they have been validly concluded on the FMDQ Exchange platform. The related trade records are updated real-time on the FMDQ Clear Clearing System. The Clearing System is an integrated system, which provides a seamless interface for derivatives trading and clearing.

With respect to the trades recorded in the Clearing System and accepted for novation, FMDQ Clear acts as the CCP to both buyers and sellers. Hence, the original contract between the buyer and seller is substituted by two (2) separate contracts (i.e., a contract with FMDQ Clear as a seller to the original buyer and the other with FMDQ Clear as the buyer to the original seller). As the CCP, FMDQ Clear assumes counterparty risks associated with the financial market products cleared.

Therefore, on every trading day, FMDQ Clear re-values all contracts (further details about the variation margin calculation can be found here) and computes individual Clearing Member’s settlement amount and associated obligations with the Clearing Members.

FMDQ Clear distributes trade and position details to Clearing Members on a real-time basis upon trade registration. Clearing reports are also produced at the end of each clearing day to facilitate Clearing Members’ operations.

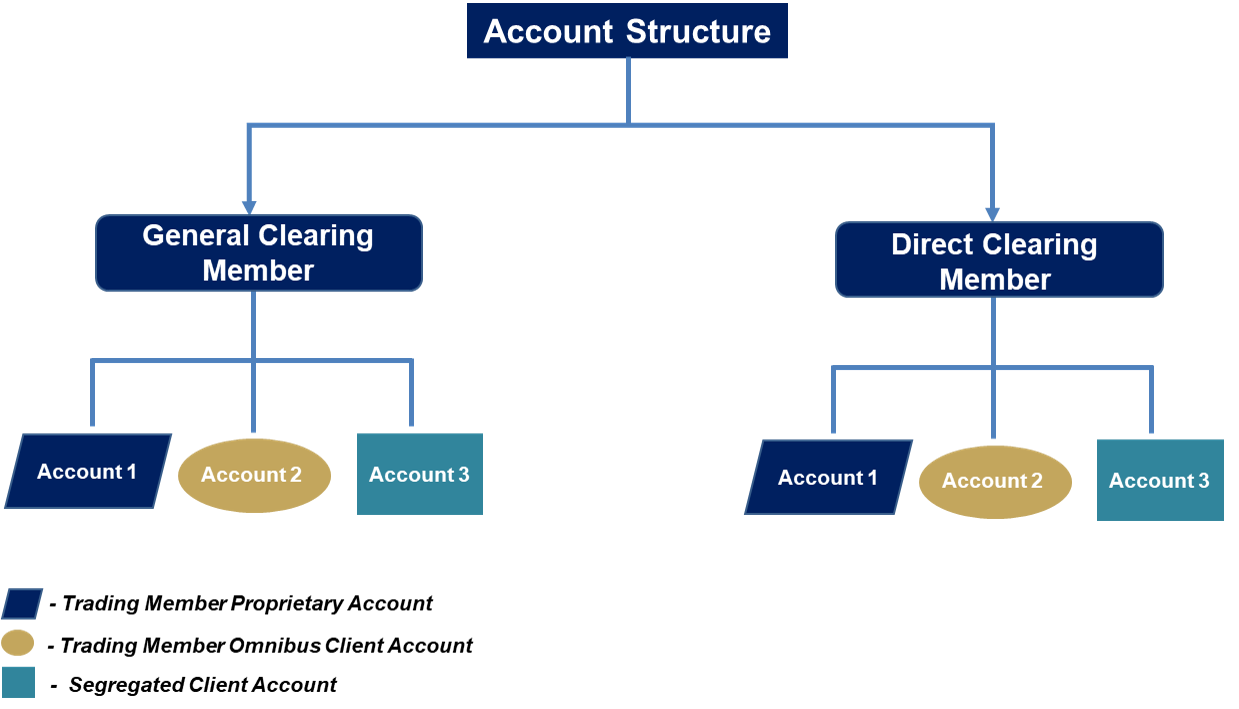

Clearing Account Structure

In line with best practice and global regulations (MiFID II and MiFIR) which require that CCPs provide their CMs with an account structure that enables the segregation of Clients’ positions and assets from proprietary positions and assets, FMDQ Clear shall require its Clearing Members to open the underlisted types of accounts:

1. Trading Member (TM) Proprietary Account (Account 1): an account where a TM’s proprietary positions and assets are registered

2. TM Omnibus Client Account (Account 2): an omnibus account where Clients’ positions and assets are registered

3. Segregated Client Account (Account 3): a segregated account where Clients’ positions and assets are registered

Trades & Position Management

FMDQ Clear processes clearing transactions on a real-time basis. Transactions executed on the Trading System will be transmitted to the Clearing System to enable FMDQ Clear and Clearing Members monitor real-time records of executed orders, matched trades and positions on Principal (proprietary) accounts. To arrive at the closing position on each contract per Principal account, FMDQ Clear will offset current day’s net position with the brought forward position on each contract. Equal and opposite positions on each contract per Principal account will be closed-out by FMDQ Clear. A ‘Position Statement’ report, showing the breakdown of positions on each contract per Principal account for a specified date range is available to FMDQ Clear and Clearing Members.

CLEARING SYSTEM & CONNECTIVITY

FMDQ Clear operates an integrated Clearing System to enable straight-through-processing of transactions. This helps to improve operational efficiency and provide better risk management controls.