Sustainable Securities – Green Bonds II: Development of the Green Bonds Market

Green Bonds are debt instruments used to raise capital to finance new and existing climate related projects (Green Projects). According to the 2021 edition of the Green Bond Principles (“GBP”), eligible Green Project categories include inter alia; renewable energy, energy efficiency, sustainable water and wastewater management, climate change adaptation etc. Refer to our July 2021 edition of the FMDQ Learning Article where we introduced readers to Green Bonds, the GBP, the milestones and performance of Green Bonds globally.

In this article, we shall be reviewing the contribution of some Securities Exchanges globally to the development and growth of the Green Bonds market.

In furtherance of the commitment of the United Nation (“UN”) to the actualisation of the Sustainable Development Goals, the UN in partnership with the United Nations Conference on Trade and Development, the United Nations Global Compact, the United Nations Environment Programme Finance Initiative and the UN-supported Principles for Responsible Investment established the Sustainable Stock Exchange (“SSE”) initiative in 2009, to explore how Exchanges can enhance performance on Environmental, social and Governance (“ESG”) issues and encourage sustainable investment.

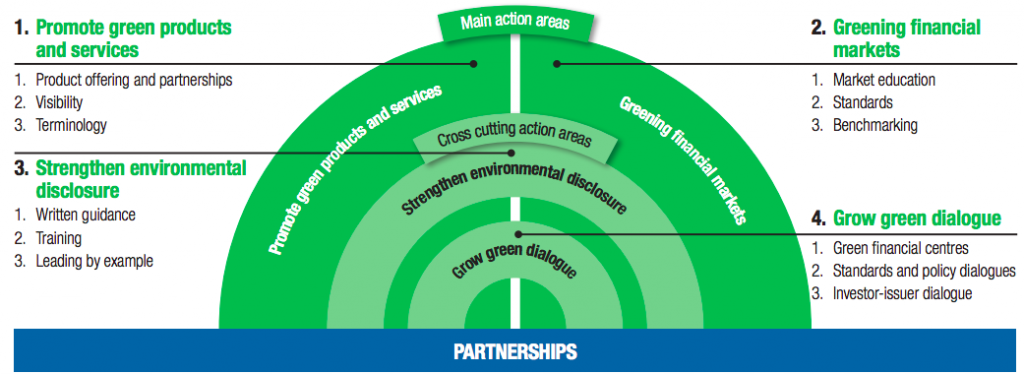

The image below illustrates the SSE’s plan to grow green finance:

In Europe, the Luxembourg Stock Exchange in 2016 launched the world’s first dedicated platform for sustainable finance; the Luxembourg Green Exchange (“LGX”), aimed at facilitating investors’ seamless access to documentation of underlying green and sustainable products to make informed investment decisions. As at August 2021, LGX has eight hundred and forty-five (845) listed securities totaling $399.36 bn

Further, The International Stock Exchange (“TISE”) launched TISE Green (now TISE Sustainable) in 2018, a market segment dedicated to facilitating the flow of capital into investments aimed at promoting ESG activities as it provides issuers and securities transparency and visibility among investors. Six (6) securities are currently listed on TISE Sustainable with a total value of $4.16bn. https://www.bourse.lu/green

The Hong Kong Exchanges and Clearing Limited launched its sustainable and green Exchange (“STAGE”), Asia’s first multi-asset sustainable investment product platform in 2020 to anchor the Asian sustainable finance ecosystem and provide access and transparency on product and other sustainable finance related resources. STAGE aims to bridge the gap between issuers and investors and promote transparency ultimately boosting the participation in the market. As of August 2021, there are fifty-four (54) Green Bonds listed on STAGE.

In Nigeria, the erstwhile FMDQ OTC Securities Exchange (now FMDQ Holdings PLC) partnered with the Financial Sector Deepening (“FSD”) Africa and Climate Bonds Initiative (“CBI”) to support the development of the Nigerian Green and non-Government Bonds markets. The partnership is aimed at enabling FMDQ Securities Exchange Limited (the “Exchange”) garner the necessary support required to promote impact investing as entrenched under the sustainable finance pillar of the FMDQ Debt Capital Markets Development (“DCMD”) Project. Kindly read about some of the contributions of the Exchange in the development of sustainable securities in the country in our March 2021 and July 2021 editions of the FMDQ Learning Article

The Exchange in its continuous desire for Nigeria to stay at the forefront of the global Green and Sustainable Finance drive aims to launch a “Green Exchange”, a virtual information platform dedicated to supporting transparency, good governance, and compliance in the growth of Green and Sustainable Finance in the Nigerian financial markets by highlighting and showcasing securities issuances that align with global ESG principles.

FMDQ Exchange continues to remain steadfast in seeking innovative ways to develop the Nigerian capital market to be resilient and liquid.